Nigeria’s maritime industry: going for growth

Economists expect Nigeria’s maritime industry to be a major contributor to the country's Gross Domestic Product since 90% of world trade is by sea. In countries like Singapore, maritime is an important lifeline, contributing about 7% to its GDP.

The maritime industry involves moving of people and goods over the water. It ensures that Nigeria, a major crude oil exporting country partakes in international trade. It also includes off-shore activities such as fishing, underwater resources, towage; and on-shore ones such as shipping, ship and port construction and maintenance.

Despite accounting for 85% of the nation's external trade—import and export passes through the nation's seaport—Nigeria’s maritime sector’s competitiveness against global and continental contemporaries is weak.

A capture of the industry reveals it contributes on average 1.6% to Nigeria's GDP. The sector has grown for an average of 3% in the last five years, with Q4 2016 8% growth as a highest in recent time. It grew by 1.87% in Q4 2019 just before COVID-19's impact on international trade.

Several challenges plague the industry, many are man-made, which solutions like an executive order have been given to make things better, yet the slow growth still exists.

Apapa’s contention with logistics and congestion issues

One clear challenge with the industry is the cargo congestion at the Apapa port and worsening logistics incompetence.

Of Nigeria’s six seaports, the Lagos Port Complex in Apapa is the largest but massively congested because of inadequate infrastructure, particularly poor access roads and inadequate cargo scanners.

The 100% physical examination that goes on in the port also contributes to the congestion, an exact opposite to the 100% scanning of US-bound containers, where high capacity scanners can scan a maximum of 150 containers per hour. Customs’ officials have been accused of waylaying cargoes for cross-checking or extorting port workers thereby causing delays.

A shorter time in any port is a positive indicator that could signal the level of efficiency and trade competitiveness. But as of March this year, waiting time in the Apapa port ranges from 14 to 41 days, this is compared to a median time of 23.5 hours (0.97 days) that ships spent on a port across the world in 2018.

Indicators like this drives the World Bank’s assessment of Nigeria’s ability and quality of logistics services. For example, logistics competence dropped to a four year low (2.4 out of 5 possible marks) as of 2018–its latest logistics performance report. Clearance processes by customs agencies are also at the lowest efficiency level since 2007.

The timing and efficiency problems are heightened by the cost of shipping goods into Nigeria. Recent research reveals that Apapa port cost of shipment is nearly five times that of Durban, South Africa, and three times that of Tema, Ghana.

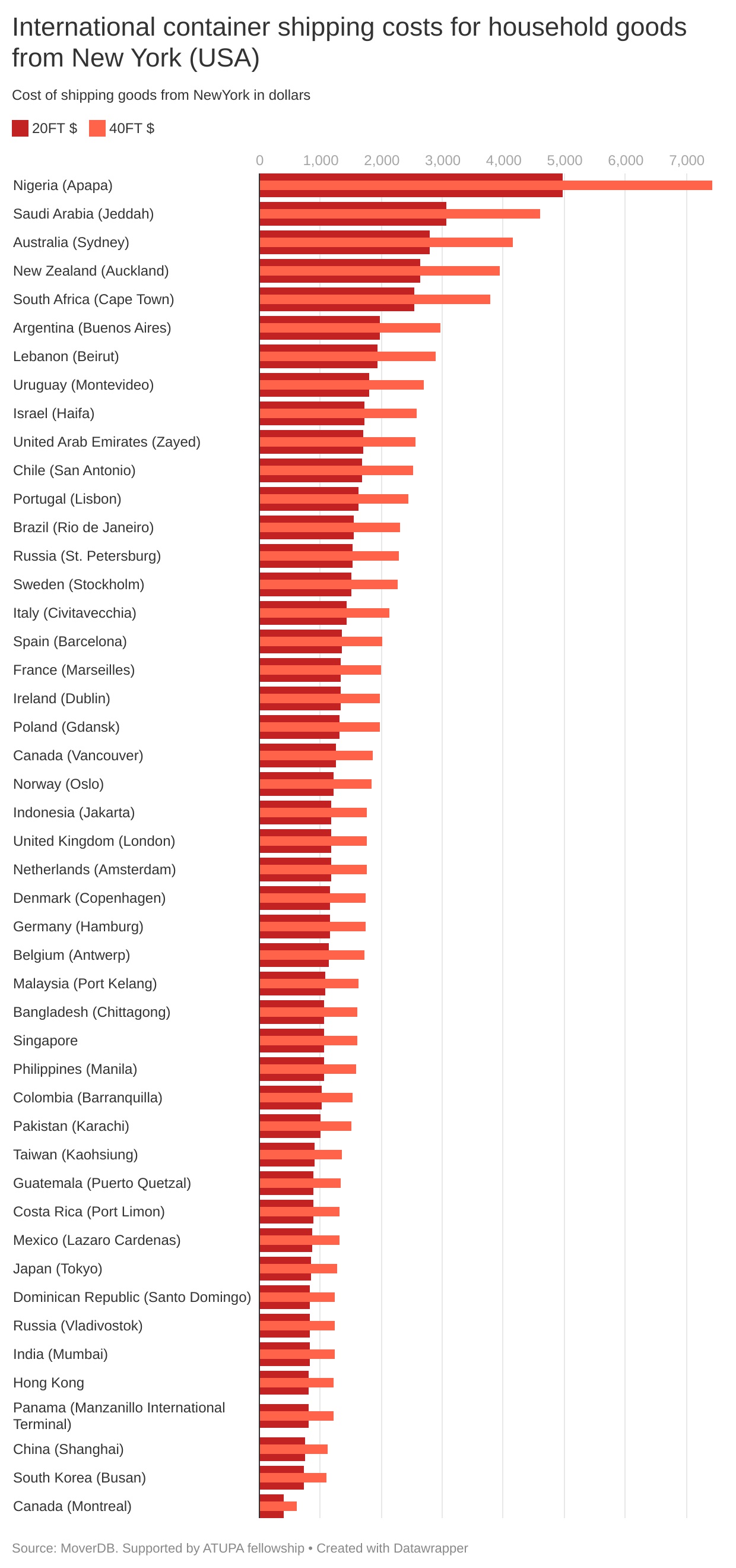

An analysis by MoverDB on overseas cargo and freight costs indicates that the cost of shipping both 20-foot and 40-foot containers to Lagos ports from New York is the most expensive in the world of the 47 port destinations analysed.

Distance is not a factor for this high cost. A quick google check shows shipping distance from New York to Lagos is 8,481 kilometres compared to the 12,757 kilometres distance from New York to South Africa. Yet shipping to Nigeria which is geographically closer is nearly double the cost of shipping to South Africa.

The country has tested several solutions to drive efficiency, including banning trucks from parking along the roads leading to the port.

In May 2017 Vice President, Yemi Osinbajo, who was the acting president at the time, even signed an executive order directing 24-hours operations at the Apapa port. He outrightly banned institutions such as the Standards Organisation of Nigeria (SON) and the National Food, Drugs Administration and Control (NAFDAC) from operating within the ports.

The ban was in an effort to ease business activities and reduce high costs, but the executive order did very little to ease the delays and bottlenecks.

Port users and government agencies breach the order at the ports and efficiency has hardly improved. In the year after the executive order, Nigeria still ranked 110 out of 160 countries in the 2018 Logistics Performance Index.

Why increase port efficiency?

Port inefficiency is the major problem hindering Nigeria's maritime industry growth. Efficient ports lower transportation cost and facilitate imports and exports of a country. Inappropriate fees and formalities, and unclear trade and transport rules and regulations have become serious obstacles to trade, thereby adversely affecting investment and job creation.

The Lagos Chamber of Commerce and Industry (LCCI) estimates that the country’s productive capacity (GDP) reduces by 3% every year as a result of business unfriendliness in seaports, terminals, and road congestion. If for instance, the deliberate delays caused by officials in Ministries Departments and Agencies (MDAs) of the government can be overturned, it would help in boosting the maritime industry’s contribution to Nigeria's GDP. A 2018 research from the LCCI explained that activities from MDAs accounted for approximately 65% and 80% of import clearance and export processing time respectively.

Port efficiency would make Nigeria more competitive as businessmen would be encouraged to engage in trade. The cost of goods and services would also reduce since the high cost of processing them would no longer be passed to consumers.

The United Nations Conference on Trade and Development (UNCTAD) recognise the duration ships stay in port as a major indicator for measuring port performance. But the complexity of port operations requires that the interaction between essential elements such as efficiency with ships, berthing, space, equipment and labour are also used to measure port performance accurately.

Increased trade volumes and lower cost of goods and services would also help develop port communities thereby boosting contributions from the maritime industry.

The future of Nigeria's maritime

The Lekki Deep Seaport was widely acclaimed to be the saviour of the maritime industry when the government announced its construction in 2013. Touted as the first deep seaport in West Africa, it was scheduled to debut in 2016 but has stalled as a result of financial constraints.

Interestingly, Hadiza Bala Usman, managing director, Nigerian Ports Authority (NPA) had claimed that it would take two years to build the port. Nevertheless, Governor Babajide Sanwo-Olu has intensified efforts to accelerate the completion of the project. He signed a contract with China Development Bank (CDB) for a $629 million financing facility to speed up the construction and complete it in 30 months.

Early this year, Steven Heukelom, the technical director of Lekki Port Enterprises Limited, disclosed that the $1.65 billion Lekki Port should commence operations by 2022.

One thing to note though is that Lekki, where the seaport is located, has only one narrow road ‘Akodo Road’ which connects the facility and several other industries.

Already, the influx of people into new towns springing up daily on the Lekki-Epe corridor has increased the number of vehicles on the road, leading to constant traffic congestion.

Upon completion, it would serve as an important alternative for easing the Lagos port congestion. But a lack of infrastructure such as rail and well-structured link roads, coupled with policies that would enforce efficiency could continue to threaten the success of the country's maritime industry.