Q2 2021: Top most-read Stears Business stories

Welcome to the most-read stories on Stears Business in Q2 2021!

It’s been another interesting quarter at the Stears Newsroom. We’ve had three new joiners, experienced the Twitter ban, and a popular editor’s cryptocurrency fortunes went from grace to grass.

Life has certainly been up and down.

However, one thing that has remained constant is our promise to deliver in-depth stories to help our community understand the economy around them. This quarter we have published 64 articles on a range of topics from insecurity to exports.

If you have missed any of these stories, our Stears Business Library is a great place to catch up on our content. In today’s read, we have ranked the most-read articles during April, May and June. Enjoy!

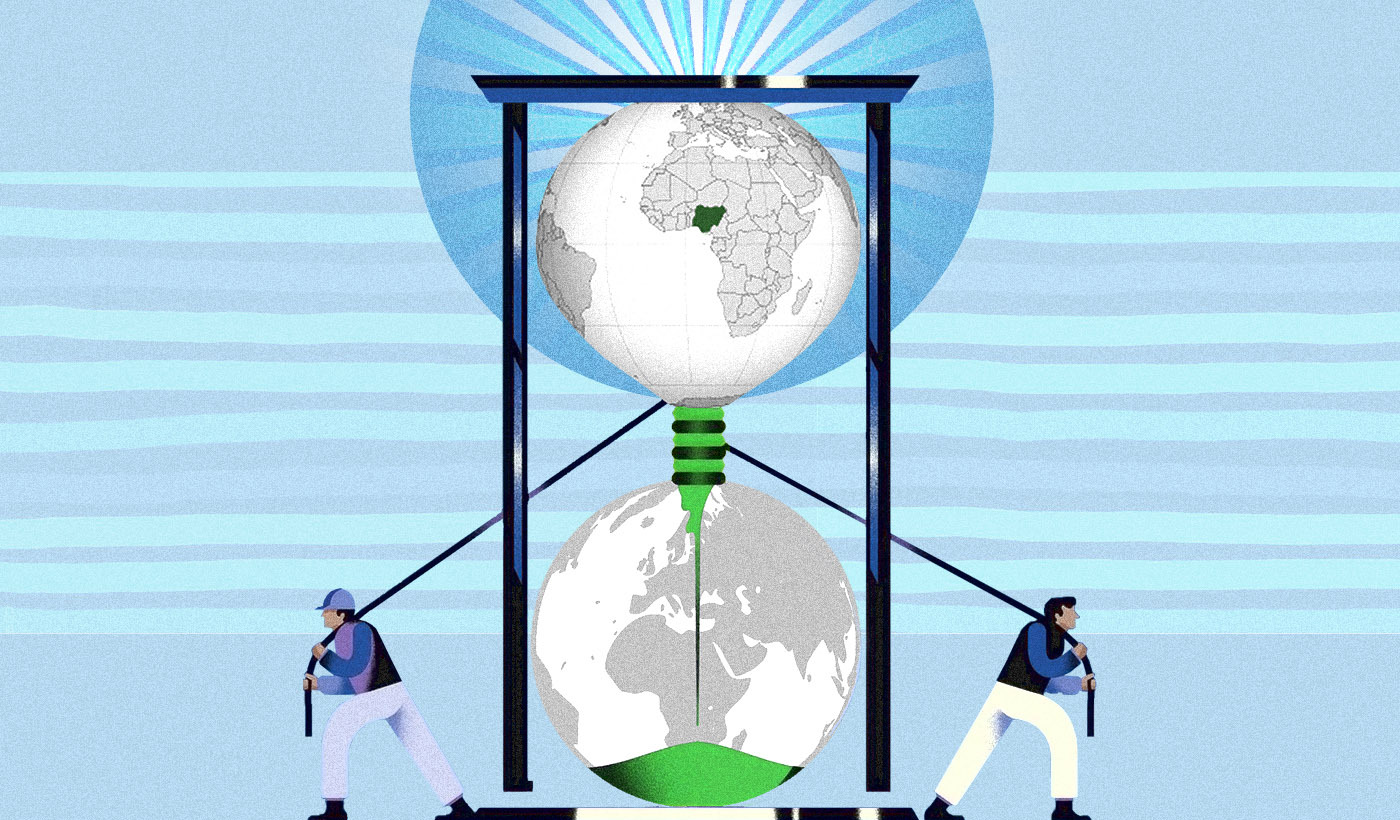

1. Nigeria’s digital naira: How it would work

Citizens of Nigeria aren’t major fans of their currency, the naira. In fact, 40% of total deposits are held in a foreign currency, which puts us in the “dollarised” category of countries. Even outside of Nigeria, there isn’t much demand for the naira because we don’t offer many exports. Right now, the naira is an unwanted product.

Back in June, the Central Bank of Nigeria announced that it would launch a digital naira within the next year. And as our Editor-in-Chief explained in this piece, we should think of this as an opportunity for the naira to evolve as a currency product.

What does digital naira mean for us, and how will it work? Will this naira upgrade the fortunes of the Nigerian economy?

Read the full article here to find out

2. Can Moove Africa make it easier to own a car in Africa?

Here are some statistics on cars in Africa’s largest economy: For every new car on the road in Nigeria, there are 131 used cars; In 2014, only 56,000 new cars were sold in Nigeria, compared to 540,000 in South Africa and 2 million vehicles sold in the UK; According to the National Bureau of Statistics, Only 10% of Nigerians have a car. In South Africa, our economic rivals, one in three people, own one.

Nigerians don’t buy new cars.

And while there are many reasons for this, one major explanation is the lack of financing opportunities available when looking to buy a car. Almost 90% of all cars bought in the UK are purchased using credit or financing. But most people in Nigeria pay for their cars in full which means they are constrained to buying used cars.

Moove, “Africa’s flexible car ownership company”, wants to plug this gap. This story looks at their business model and the company’s potential to provide taxi and personal drivers with better driving options.

Read the full article here

3. Travelling by water in Lagos: High costs and solutions

Our Deputy Editor, Adesola, shares some of her water travel experiences in Nigeria in this story. On one occasion, the boat she was on stopped in the middle of the sea because there was no more fuel in the tank. Her boat trips were also expensive. In some instances, it could cost two times more to travel via boat than by road. It all seems like a dead-end, but it’s not. You see, while a road trip from Ikorodu to CMS might take almost 3 hours, it can be done in 30 minutes via sea in Lagos.

How do we make travel by water a better option?

Read the full article here

4. We live in a successful failed state

On the 4th of June, one of our editors met with a couple of ministers about the Nigerian digital economy. It seemed like a good day for progress. As the meeting drew to a close, the Nigerian government dropped a bombshell. They had announced that Twitter would be banned after the social media app deleted a Tweet on the president’s account. Very quickly, our optimistic hopes for Nigeria’s digital economy were dashed. You see, Nigeria is a failed state. Not just that, it is a successful failed state because it does a good job of hiding that it is indeed a failed state.

Read the full article from our CEO here

5. How 18 years olds are becoming millionaires with cryptocurrencies

One of the major events of 2021 has to be the boom in cryptocurrencies. Bitcoin, which was once only known to a few individuals in the internet’s dark spaces, became a dinner table discussion with grandma and grandpa. The wild thing about the recent boom in these digital currencies is the influence of young millennials and generation Z kids. The crypto market hasn’t only moved as a result of Elon Musk Tweets; fanfare in the hallways of Reddit and TikTok has also manipulated it.

In this story, we walk through some major events in the cryptocurrency space this quarter and how young adults are making money from coins that started off as memes.

Read the full article here

6. Nigeria’s youth unemployment problem

Nigeria relies on its youths. The median age of the country’s population is 18, and people from age 15-34 account for half of our labour force. That said, the youth also bear the brunt of Nigeria’s tough economy. Our current unemployment rate is 33%, but for youths, it is a whopping 42%. Over half of 15-24-year-olds are currently unemployed.

Nigeria has many problems, but this is one of its largest. What is the government doing about it, and how can we give Nigeria’s youths a better future?

Read the full article here

7. Why is the naira always falling?

The first article on this list spoke about how the naira is an unwanted product. And quite simply, that explains a big chunk of why the naira’s value is always falling compared to foreign currencies.

But the thing to remember about exchange rates is that they are not “real.” Nigeria can decide to divide its currency by 100, and the exchange rate would go from ₦400 = $1 to ₦4 = $1. Would that make anyone better off? Not really. In the end, an exchange rate is a nominal number that can be manipulated either way. It is a representation of what the actual economy is doing, but it is not the economy. Let us rephrase, “fixing” the exchange rate might not fix the economy, but fixing the economy might lead to a more stable exchange rate.

Read the full article here.

8. Nigeria’s export crisis: How we are spending more than we earn

One would think that nothing can be shocking about the Nigerian economy anymore, but this article showed that there could be more. Michael, the Chief Economist at Stears, painted a very gloomy picture of Nigeria's export situation in just nine charts. The statistic going around is that our oil exports have gone from around $100 billion in 2012 to $26 billion in 2020.

When you couple that with the recent rise in imports from Nigeria’s manufacturing sector, it’s clear to see why Nigeria’s exchange rate has been struggling recently. There is a high demand for dollars and very little supply of it.

But it’s not just oil exports that have suffered. Non-oil goods have also had their fair share of struggles in recent times. It's the definition of a crisis as Nigeria tries to pivot away from oil export earnings.

Read the full article here

9. Why Nigeria’s fashion workers are booked busy but underpaid

Nigeria’s creative industry is one of the good things the country has going for it. Our films, music and fashion are celebrated at home and abroad. By definition, creative sectors like fashion have a more laissez-faire approach to work and operations. It makes sense; being too rules-based or overly formal can restrict creativity. That said, it does come with disadvantages. Employment in Nigeria’s fashion industry is arguably too informal for its own good. People are hired to do too many roles for little pay, and employers exploit the intern nature of the industry.

In this article, Marie, our new Creative Industries Analyst, assesses the current employment structure and how we can progress.

Read the full article here

10. Why insecurity has increased in Nigeria

This quarter was particularly scary for Nigerians. From robberies on Eko Bridge in Lagos to kidnappings from Kaduna schools, the country is facing a war with terror. . In one week in May, over 239 people were killed and 44 kidnapped—crimes mostly committed by armed bandits. It’s clear to everyone that insecurity is probably the biggest problem Nigeria has to deal with this year. But to tackle it, we must first understand why it’s happening.

In this story, we break down the data to show how people are turning to violence to take them out of poverty.

Read the full article here